Transition Bonds

NYK has been working to deepen its ESG financing as part of its ESG management, starting with the issuance of the world's first green bond by an ocean shipping company in May 2018.

NYK will continue its efforts to keep a wide range of stakeholders involved in the company's proactive approach to environmental investment as the company makes efforts to contribute to realizing a sustainable society through technology that lessens environmental burdens.

- More Information:

Transition Bonds (No.3)

Summary

| Name | NYK Unsecured Corporate Bonds No. 47 (Transition Bonds) |

|---|---|

| Issue date | April 17, 2024 |

| Pricing date | April 10, 2024 |

| Maturity | 5 years |

| Issue Amount | 10 billion yen |

| Coupon Rate | 0.722% per annum |

| Use of Proceeds | New and existing projects referenced in "vessel fuel conversion scenario towards 2050" in NYK's medium-term management plan; LNG-fueled vessels |

| Framework | |

| Credit ratings | AA- (Japan Credit Rating Agency, Ltd.) |

Third-party Assessment

Second Party Opinion

NYK developed its Green/Transition Bond Framework in July 2021, and DNV Business Assurance Japan K.K., an independent external reviewer, provided a second-party opinion. Under this framework, NYK issued transition bonds (No. 1) in July 2021 and transition bonds (No. 2) in July 2023.

In January 2024, the framework was revised and renamed as the Green/Transition Finance Framework (hereinafter, "this framework"). DNV Business Assurance Japan K.K. has provided a second-party opinion confirming that this framework is aligned with Green Bond Principles 2021 (ICMA), Green Bond Guidelines 2022 (Ministry of the Environment, Japan), Green Loan Principles 2023 (LMA), Green Loan Guidelines 2022 (Ministry of the Environment, Japan), Climate Transition Finance Handbook 2023 (ICMA), and Basic Guidelines on Climate Transition Finance (May 2021) (Financial Services Agency, Japan; Ministry of Economy, Trade and Industry, Japan; and Ministry of the Environment, Japan).

DNV Business Assurance Japan K.K. also provided a second-party opinion confirming the above alignment for transition bonds (No. 3).

- More Information:

List of NYK Transition Bond (No. 3) Investors

Investors that have emphasized the significance of NYK's issuance of transition bonds (No. 3) and have committed to investing (as of April 10, 2024) include the following:

- The Aichi Bank, Ltd.

- Aichibitou Japan Agricultural Cooperatives

- The Akita Bank, Ltd.

- Asset Management One Co.,Ltd.

- Ichinoseki Shinkin Bank

- THE OITA BANK, LTD.

- THE OSAKA CITY SHINKIN BANK

- Kagoshima Credit Federations of Agricultural Cooperatives

- THE KANAGAWA BANK, LTD.

- JA kanagawaseisho

- Kumagaya Japan Agricultural Cooperatives

- THE BANK OF KOCHI, LTD.

- Kobeshi Shokuin Shinkumi Bank

- The Kobe Shinkin Bank

- THE SAGA KYOEI BANK, LTD.

- Saganishi Shinkumi Bank.

- SHIGA PREFECTURAL CREDIT FEDERATION OF AGRICULTURAL CO-OPERATIVES

- Shizuoka Prefectural Credit Federation of Agricultural Cooperatives

- Japan Automobile Recycling Promotion Center

- SHINONOME SHINKIN BANK

- SHIBAURA TSUSEN Co.,Ltd.

- The Gibraltar Life Insurance Co.,Ltd.

- The Juroku Bank, Ltd.

- SUMITOMO LIFE INSURANCE COMPANY

- Zentouei Shinyoukumiai

- THE CHUKYO BANK, Ltd.

- Nagasaki Mitsubishi Credit Union

- JA NISHIMIKAWA

- Nissay Asset Management Corporation

- Hakusan Shinkin Bank

- Fukuokaken Shinkumi Bank

- Fukushima Shinkin Bank

- THE FUJI SHINKIN BANK

- North Pacific Bank, LTD.

- Hokuriku Labour Bank

- Mizusawa Shinkin Bank

- LIFENET INSURANCE COMPANY

Summary of Green/Transition Finance Framework

1. The NYK Group's Absolute Corporate Emissions Targets

In "NYK Group ESG Story 2023," the NYK Group established the new absolute corporate emissions targets (baseline: 2021) indicated below.

Total fiscal 2030 emissions from Scope 1 (direct GHG emissions) and Scope 2 (indirect GHG emissions such as electricity use) should be 45% less than the amount recorded in fiscal 2021. In addition, as a long-term target, the total amount of fiscal 2050 emissions, including Scope 3 (emissions in the supply chain), should be net zero. We will adopt two approaches to achieve these targets: GHG reduction and GHG removal.

- More Information:

2. Use of Proceeds

NYK plans to allocate the proceeds from green/transition bonds to finance new and existing investments related to eligible projects, such as those indicated below. Transition bonds will be used for LNG-fueled vessels.

・Green Projects (Funds raised by green bonds and transition bonds can be allocated)

Renewable energy (offshore wind power, green terminals), ammonia-fueled vessels, hydrogen fuel-cell vessels

・Transition Projects (Funds raised by transition bonds can be exclusively allocated)

LNG-fueled vessels, LNG bunkering vessels, LPG-fueled vessels, operation efficiency & optimization

Transition Bonds (No.2)

Summary

| Name | NYK Unsecured Corporate Bonds No. 45 (Transition Bond) | NYK Unsecured Corporate Bonds No. 46 (Transition Bond) |

|---|---|---|

| Issue date | July 21, 2023 | |

| Pricing date | July 14, 2023 | |

| Maturity | 5 years | 10 years |

| Issue Amount | 10 billion yen | 10 billion yen |

| Coupon Rate | 0.439% per annum | 0.910% per annum |

| Use of Proceeds | New and existing projects referenced in "vessel fuel conversion scenario towards 2050" in NYK's medium-term management plan. LNG-fueled vessels, LPG-fueled vessels |

|

| Framework | ||

| Credit ratings | A+ (Japan Credit Rating Agency, Ltd.) | |

Third-party Assessment

Second Party Opinion

NYK has developed a Green/Transition Bond Framework (hereinafter, "this framework"). DNV Business Assurance Japan Co. Ltd., an independent external reviewer, has provided a second-party opinion confirming that this framework is aligned with the Green Bond Principles 2021 (ICMA), Green Bond Guidelines 2020 (Ministry of the Environment, Japan), Climate Transition Finance Handbook 2020 (ICMA), and Basic Guidelines on Climate Transition Finance (May 2021) (Financial Services Agency, Japan; Ministry of Economy, Trade and Industry, Japan; and Ministry of the Environment, Japan). NYK issued transition bonds (No. 1) under this framework in July 2021.

DNV Business Assurance Japan Co. Ltd. also provided a second-party opinion confirming the above alignment for transition bonds (No. 2).

- More Information:

List of NYK Transition Bond (No. 2) Investors

Investors that have emphasized the significance of NYK's issuance of transition bonds (No. 2) and have committed to investing (as of July 14, 2023) include the following:

- DaitokyoShinkumi Credit Cooperative

- Numazu Shinkin Bank

- HOKKAIDO SHINKIN BANK

- Iwateken Ishi Shinkumi Bank

- KITAMI SHINKIN BANK

- JA HigashiMino

- Gunmaken Ishi Shinkumi Bank

- Kyouritsu Shinkumi

- The Kobe Shinkin Bank

- The Dai-ichi Life Insurance Company, Limited

- Shizuoka Prefectural Credit Federation of Agricultural Cooperatives

- The Toho Bank, Ltd.

- THE KURE SHINKIN BANK

- The Sugamo Shinkin Bank

- The Hekikai Shinkin Bank

- THE BANK OF KOCHI, LTD

- Iwaki Shinkumi

- NIHON DENGI CO.,LTD.

- The Aichi Bank, Ltd.

- The First Bank of Toyama,Ltd.

- HIROSE ELECTRIC CO.,LTD.

- SUMITOMO LIFE INSURANCE COMPANY

- Ibaraki Prefectural Credit Federations of Agricultural Cooperatives

- KOITO MANUFACTURING Co.,Ltd.

- Shinkin Central Bank

- Abukuma Shinkin Bank

- JA Higashibiwako

- Fukuoka Shinkin Bank

- AICHIKEN IRYO SHINYO KUMIAI

- Aichi Shinkin Bank

- North Pacific Bank, LTD.

- KIBI SHINKIN BANK

- The Mitsubishi Economic Research Institute

- SAGA PREFECTURAL CREDIT FEDERATION OF AGRICULTURAL COOPERATIVES

- Mitsui Sumitomo Insurance Company, Limited

- Matsumoto Shinkin Bank

- The Seto Shinkin Bank

- Himifusiki Shinkin Bank

- TONO SHINKIN BANK

- Nakahyogo Shinkin Bank

- THE NAGANO SHINKIN BANK

- THE TSURUGA SHINKIN BANK

- Echigojoetsu Japan Agricultural Cooperatives

- SANYO KAIJI Co.,Ltd.

- SHIBAURA TSUSEN Co.,Ltd.

- JA Aichi-Kita

- Yamaguchikennougyoukyoudoukumiai

Summary of the Green/Transition Bond Framework

1. NYK Group GHG Emissions Intensity Reduction Targets

In March 2022, NYK announced a new NYK Group ESG Story and in march 2023 released a new four-year medium-term management plan "Sail Green, Drive Transformations 2026 -- A Passion for Planetary Wellbeing," following the formulation of the Green/Transition Bond Framework in July 2021.

In the new NYK Group ESG Story and medium-term management plan, the 2050 target has been revised upward from a 50% reduction of ESG emissions to net zero (Determined in September 2021).

- More Information:

2. Use of Proceeds

NYK plans to allocate the proceeds from green/transition bonds to finance new and existing investments related to eligible projects, such as those indicated below. Transition bonds (No. 2) will be used for LNG-fueled and LPG-fueled vessels, among others.

・Green Projects (Funds raised by green bonds and transition bonds can be allocated)

Renewable energy (offshore wind power, green terminals), ammonia-fueled vessels, hydrogen fuel-cell vessels

・Transition Projects (Funds raised by transition bonds can be exclusively allocated)

LNG-fueled vessels, LNG bunkering vessels, LPG-fueled vessels, operation efficiency & optimization

Transition Bonds (No.1)

Summary

| Name | NYK Unsecured Corporate Bonds No. 43 (Transition Bond) | NYK Unsecured Corporate Bonds No. 44 (Transition Bond) |

|---|---|---|

| Issue date | July 29, 2021 | |

| Pricing date | July 21, 2021 | |

| Maturity | 5 years | 7 years |

| Issue Amount | 10 billion yen | 10 billion yen |

| Coupon Rate | 0.26% per annum | 0.38% per annum |

| Use of Proceeds | New and existing projects referenced in "Our Business Development Timeline in the Energy Field" in NYK Group ESG Story Offshore-wind support vessels, ammonia-fueled vessels, hydrogen fuel-cell vessels, LNG-fueled vessels, LNG-bunkering vessels, LPG-fueled vessels, improvement of efficiency and optimization in vessel operation |

|

| Framework | ||

| Credit ratings | A- (Japan Credit Rating Agency, Ltd.) | |

Third-party Assessment

Second Party Opinion

NYK has developed the Green/Transition Bond Framework (hereinafter, "this framework"). This framework has obtained a second party opinion from DNV Business Assurance Japan Co. Ltd. as an independent external reviewer that this framework is aligned with the Green Bond Principles 2021 (ICMA), Green Bond Guidelines 2020 (Ministry of the Environment, Japan), Climate Transition Finance Handbook 2020 (ICMA), and Basic Guidelines on Climate Transition Finance (May 2021) (Financial Services Agency, Japan; Ministry of Economy, Trade and Industry, Japan; and Ministry of the Environment, Japan). NYK will issue the green/transition bonds under this framework.

- More Information:

Model Case Selection for Transition Finance

The issuance has been selected as the first model case for transition finance by Japan's Ministry of Economy, Trade and Industry.

List of NYK Transition Bond Investors

Investors who have emphasized the significance of NYK's transition bond issuance and have committed to investing (as of July 21, 2021)

- Fukoku Mutual Life Insurance Company

- BIHOKU SHINKIN BANK

- Midori Life Insurance Co.,Ltd.

- Boso Shinkumi

- The Dai-ichi Frontier Life Insurance Co.,Ltd.

- DaitokyoShinkumi Credit Cooperative

- The Dai-ichi Life Insurance Company, Limited

- Danyo Shinkumi Bank

- Saison Automobile and Fire Insurance Company, Limited

- JA Fukuoka Shinren

- THE DAIDO FIRE AND MARINE INSURANCE Co.,Ltd.

- The Gamagori Shinkin Bank

- The Toa Reinsurance Company, Limited.

- THE GIFU SHINKIN BANK

- Asset Management One Co.,Ltd.

- Himifusiki Shinkin Bank

- Sumitomo Mitsui Trust Asset Management Co.,Ltd.

- The Hiroshimashi Credit Cooperative

- Mitsubishi UFJ Trust and Banking Corporation

- Hokkaido Labour Bank

- Meiji Yasuda Asset Management Company Ltd.

- Hokuriku Labour Bank

- Nissay Asset Management Corporation

- The Hyogoken Credit Cooperative

- Sumitomo Mitsui DS Asset Management Company, Limited

- HYOGOKEN IRYO CREDIT UNION

- Tokio Marine Asset Management Co.,Ltd.

- AICHICHITA AGRICULTURAL COOPERATIVE ASSOCIATION

- Shinkin Central Bank

- Fujinomiya Japan Agricultural Cooperatives

- The Aichi Bank, Ltd.

- JA FUKAYA

- The Ashikaga Bank, Ltd.

- JA IZUNOKUNI

- The First Bank of Toyama,Ltd.

- Kawanoe Shinkin Bank

- North Pacific Bank, LTD.

- THE KURE SHINKIN BANK

- THE ALUPUSCHUO SHINKIN BANK

- THE MISHIMA SHINKIN BANK

- ASAHIKAWA SHINKIN BANK

- Moka Credit Union

- THE FUJI SHINKIN BANK

- Nagano Prefectural Credit Federation of Agricultural Cooperatives

- FUKUI SHINKIN BANK

- Niigata credit union

- HANDA SHINKIN BANK

- Nishihyogo Shinkin Bank

- Hanno Shinkin Bank

- OGAKISEINO SHINKIN BANK

- IBARAKI Prefectual Credit Federations of Agricultual Cooperatives

- OHTAWARA SHINKIN BANK

- Ichinoseki Shinkin Bank

- Osaka Shinkin Bank

- JA KAMOTO

- The SAGAMI Shinkin Bank

- The Kita Osaka Shinkin Bank

- The Seto Shinkin Bank

- The Kobe Shinkin Bank

- Shiga Kenmin Shinkumi Bank

- Mie Prefecture credit federation of agricultural cooperatives

- SHOWA SHINKIN BANK

- THE MIZUSAWA SHINKIN BANK

- TAKAMATSU SHINKIN BANK

- Nihonkai Shinkin Bank

- Takaoka Shinkin Bank

- THE NUMAZU SHINKIN BANK

- The IO Shinkin Bank

- Ome Shinkin Bank

- THE CHOSHI SHINKIN BANK

- The Seiwa Credit Cooperative

- THE HEKIKAI SHINKIN BANK

- Sekishinkin-Bank

- Iizuka Shinkin Bank

- The Sugamo Shinkin Bank

- THE JOHOKU SHINKIN BANK

- TOKYO BAY SHINKIN

- NAGANO SHINKIN BANK

- Tokyo City Shinkin Bank

- The Sawayaka Shinkin Bank

- TSURUOKA SHINKIN BANK

- SHINONOME SHINKIN BANK

- THE YAMATO SHINKIN BANK

- TOKACHI SHINKUMI

- IZAWA METAL Co.,Ltd.

- TOSHUN SHINKIN BANK

- Kojimachi kyousaikai

- Tsu Shinkin Bank

- TECHNO RYOWA LTD.

- The Tsuru Credit Cooperative

- THE JAPAN CARGO TALLY CORPORATION

- JABANK-YAMAGUCHI

- Manulife Investment Management (Japan) Limited

- ICOM INCORPORATED

- JAPAN POST INSURANCE Co.,Ltd.

- The Japan Economic Research Institute

- THE SHIZUOKA CHUO BANK, LTD.

- Osaka City Employees' Mutual Aid Association

- THE SAGA KYOEI BANK, LTD.

- Seinan Gakuin Educational Foundation

- Aichi Shinkin Bank

- School Corporation Seishin Joshi Gakuin

- AICHI POLICE CREDIT UNION

- SHIBAURA TSUSEN Co.,Ltd.

Summary of the Green/Transition Bond Framework

1. NYK Group GHG Emissions Intensity Reduction Targets

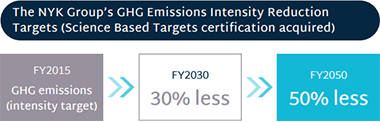

In NYK Group ESG Story (released in February 2021), The NYK Group's GHG emissions intensity reduction targets (Base line: 2015) are indicated below.

Improvements in intangible aspects of ship operations, tangible improvements in ships, and fuel conversion are expected to result in GHG emission reduction benefits (30% less) by fiscal 2030. To achieve the 50% reduction target by fiscal 2050, the introduction of zero-emission ships will be essential, and we are setting our sights on the adoption of new technologies to this end.

2. Use of Proceeds

NYK plans to allocate the proceeds from green/transition bonds to finance new and existing investments related to eligible projects, such as those indicated below.

・Green Projects (Funds raised by green bonds and transition bonds can be allocated)

Renewable energy (offshore wind power, green terminals), ammonia-fueled vessels, hydrogen fuel-cell vessels

・Transition Projects (Funds raised by transition bonds can be exclusively allocated)

LNG-fueled vessels, LNG bunkering vessels, LPG-fueled vessels, operation efficiency & optimization

3. Reporting

Post Issuance Review by Third-Party

Report on Use of Proceeds

All bond proceeds had been allocated by May 2022.

① Allocated to LNG-fueled Vessels: ¥11.6 billion

② Allocated to LPG-fueled Vessels: ¥8.4 billion

- *¥6.9billion out of above ¥20billion was used for refinancing

As of July 2022, one of the LNG-fueled vessels had already been completed. Construction of all the other vessels are on schedule, and they are going to be completed by November 2023,

Impact Report

| (1) LNG-fueled vessels | 2 ships |

| GHG emissions | 36,580 mt / ship / year |

| CO2 reduction rate | 28% |

| NOx reduction rate | 75% |

| SOx reduction rate | 99% |

| (2) LPG-fueled vessels | 2 ships |

| GHG emissions | 36,980 mt / ship / year |

| CO2 reduction rate | 15% |

| SOx reduction rate | 99% |

- *The reduction rates above are theoretical values compared with a conventional heavy oil-fueled vessel.

- *The period in the Impact Report is from July 2021 to March 2022.