NYK in Five Minutes

What do we do?

We have three main business sectors.

- Liner Trade Business

- Air Cargo Transportation Business

- Logistics Business

- Dry Bulk Business Division

- Energy Business Division

- Automotive Business Division

- Real Estate Business

- Other Business Services

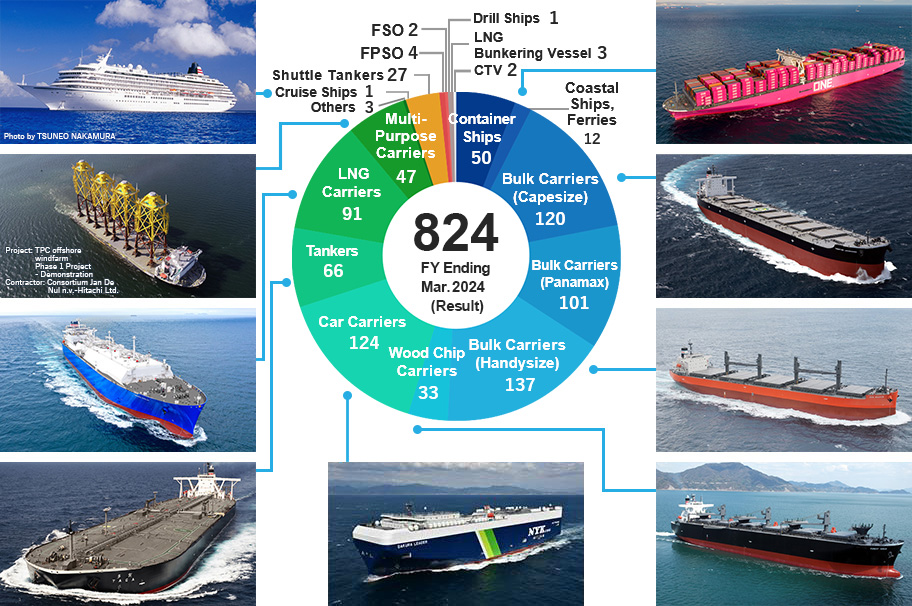

We operate various kinds of ships, e.g., containership, oil tankers, and car carriers.

What we will be doing in the future?

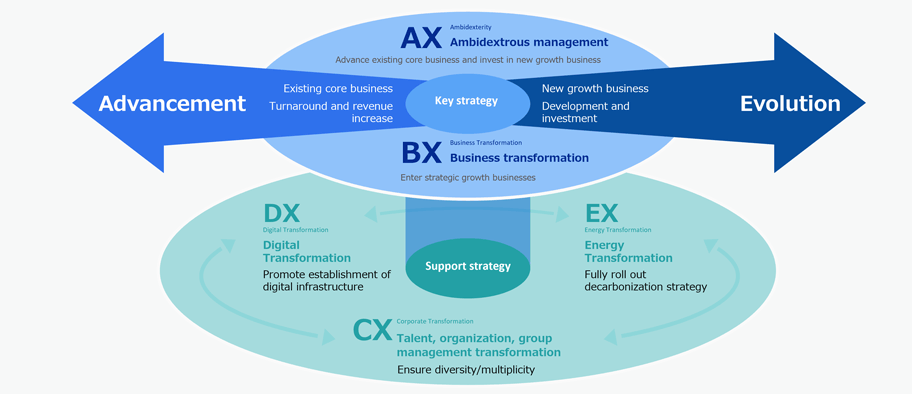

We aim to realize sustainable growth in line with the medium-term management plan.

Medium-term management plan basic strategy

We go beyond the scope of a comprehensive global logistics enterprise to co-create value required for the future by advancing our core business and growing new ones.

- Existing core business : Liner & Logistics Business, Bulk Shipping Business, Cruise Business

- New growth business : Green Business etc.

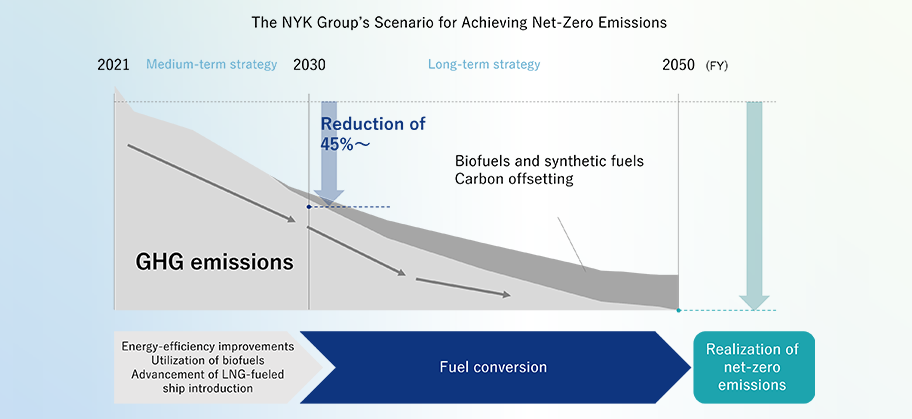

As a group that leads the industry, we will promote the launch of next-generation fuel ships through aggressive advance investments, the development and implementation of new technologies through co-creation with partners, and the establishment of a supply chain for next-generation fuels, with the goal of achieving net zero emissions in 2050.

*We updated the target for GHG reduction on November 6th, 2023.

- Medium-Term Target: -45% by FY 2030 (Base year: FY 2021, Scope: Scope-1 and Scope-2)

- Long-Term Target: Net zero emissions by FY 2050 (Scope: Scope-1, Scope-2 and Scope-3)

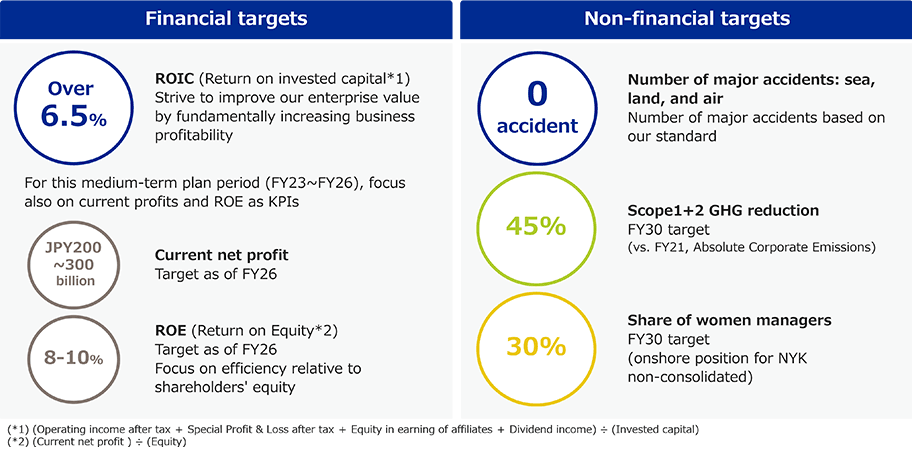

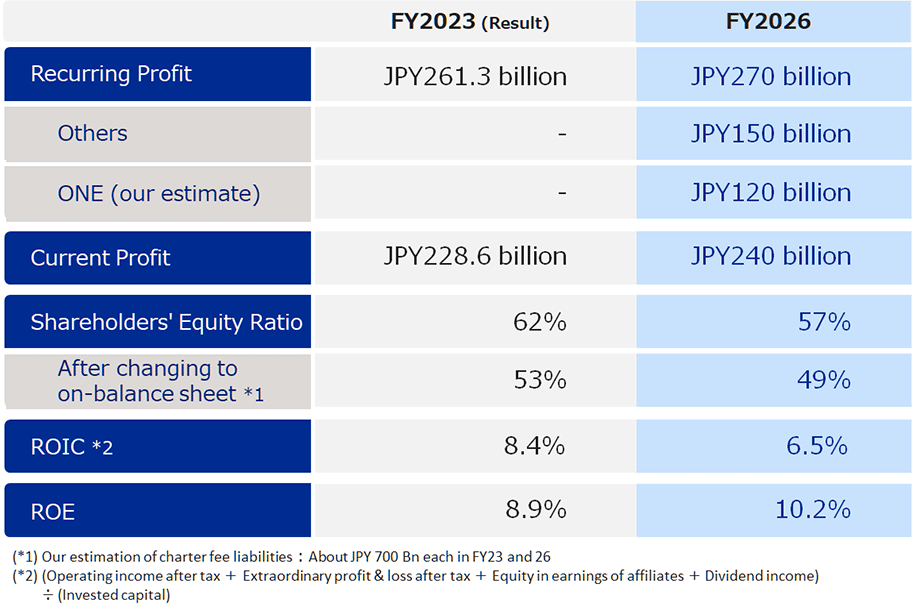

What are our financial targets?

We seek to achieve the earnings and financial targets below through a strategic cash allocation plan and financial target controls for KPI such as Shareholder's Equity Ratio and ROIC.

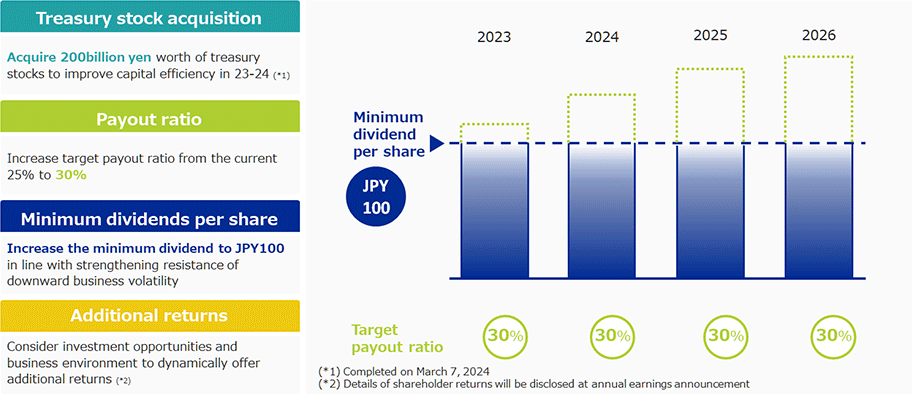

We will distribute increased profits to all shareholders.

We have designated the stable return of profits to shareholders as one of the most important management priorities, and the distribution of profits is decided after comprehensively taking into account the business forecast and other factors.

During the period of the current medium-term management plan, we established the following basic policies to increase TSR (Total Shareholder Returns) while balancing capital-efficiency improvement with growth-oriented investments.