Green Bonds

NYK has been working to deepen its ESG financing as part of its ESG management, starting with the issuance of the world's first green bond by an ocean shipping company in May 2018.

NYK will continue its efforts to keep a wide range of stakeholders involved in the company's proactive approach to environmental investment as the company makes efforts to contribute to realizing a sustainable society through technology that lessens environmental burdens.

- More Information:

Green Bonds (No.2)

Summary

| Name | NYK Unsecured Corporate Bonds No.48 (Green Bonds) |

|---|---|

| Issue date | April 17, 2024 |

| Pricing date | April 10, 2024 |

| Maturity | 10 years |

| Issue Amount | 10 billion yen |

| Coupon Rate | 1.175% per annum |

| Use of Proceeds | New and existing projects referenced in "vessel fuel conversion scenario towards 2050" in NYK's medium-term management plan; ammonia-fueled vessels

|

| Framework | |

| Credit ratings | AA- (Japan Credit Rating Agency, Ltd.) |

Third-party Assessment

Second Party Opinion

NYK developed its Green/Transition Bond Framework in July 2021, and DNV Business Assurance Japan K.K., an independent external reviewer, provided a second-party opinion. Under this framework, NYK issued transition bonds (No. 1) in July 2021 and transition bonds (No. 2) in July 2023.

In January 2024, the framework was revised and renamed as the Green/Transition Finance Framework (hereinafter, "this framework"). DNV Business Assurance Japan K.K. has provided a second-party opinion confirming that this framework is aligned with Green Bond Principles 2021 (ICMA), Green Bond Guidelines 2022 (Ministry of the Environment, Japan), Green Loan Principles 2023 (LMA), Green Loan Guidelines 2022 (Ministry of the Environment, Japan), Climate Transition Finance Handbook 2023 (ICMA), and Basic Guidelines on Climate Transition Finance (May 2021) (Financial Services Agency, Japan; Ministry of Economy, Trade and Industry, Japan; and Ministry of the Environment, Japan).

DNV Business Assurance Japan K.K. also provided a second-party opinion confirming the above alignment for green bonds (No. 2).

- More Information:

List of NYK Green Bond (No.2) Investors

Investors that have emphasized the significance of NYK's issuance of green bonds (No. 2) and have committed to investing (as of April 10, 2024) include the following:

- Asset Management One Co.,Ltd.

- Iwateken Ishi Shinkumi Bank

- JA Echigo Joetsu

- ECHIZEN SHINKIN BANK

- Enshu Shinkin Bank

- KANSAI UNIVERSITY

- JA Kouka

- THE SHIZUOKA CHUO BANK, LTD.

- The Gibraltar Life Insurance Co.,Ltd.

- Suwa Shinkin Bank

- The Dai-ichi Life Insurance Company, Limited

- Daitokyo Shinkumi Credit Cooperative

- TSURUOKA SHINKIN BANK

- The Too Shinkin Bank

- TOSHUN SHINKIN BANK

- Agricultural Cooperatives TOUTO

- TONO SHINKIN BANK

- Dokkyo University

- Nagaoka Shinkin Bank

- Nagano Shinkin Bank

- Niigata Shinkin Bank

- THE NUMAZU SHINKIN BANK

- Norinchukin Zenkyoren Asset Management Co.,Ltd.

- Hanno Shinkin Bank

- Fukuoka Shinkin Bank

- Fukoku Mutual Life Insurance Company

- FUJINOMIYA SHINKIN BANK

- The Prudential Gibraltar Financial Life Insurance Co.,Ltd.

- The Prudential Life Insurance Company, Ltd.

- Matsumoto Shinkin Bank

- The Mishima Shinkin Bank

Summary of Green/Transition Finance Framework

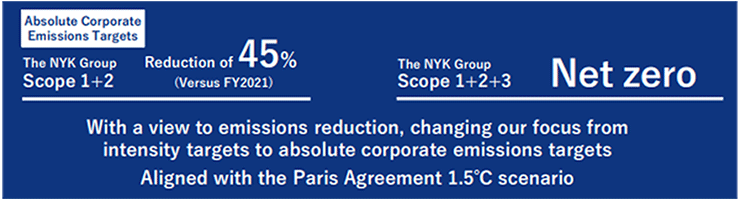

1. The NYK Group's Absolute Corporate Emissions Targets

In "NYK Group ESG Story 2023," the NYK Group established the new absolute corporate emissions targets (baseline: 2021) indicated below.

The total fiscal 2030 emissions from Scope 1 (direct GHG emissions) and Scope 2 (indirect GHG emissions such as electricity use) should be 45% less than the amount recorded in fiscal 2021. In addition, as a long-term target, the total amount of fiscal 2050 emissions, including Scope 3 (emissions in the supply chain), should be net zero. We will adopt two approaches to achieve these targets: GHG reduction and GHG removal.

- More Information:

2. Use of Proceeds

NYK plans to allocate the proceeds from green/transition bonds to finance new and existing investments related to eligible projects, such as those indicated below. Green bonds will be used for ammonia-fueled vessels.

(1) Green Projects (Funds raised by green bonds and transition bonds can be allocated)

Renewable energy (offshore wind power, green terminals), ammonia-fueled vessels, hydrogen fuel-cell vessels

(2) Transition Projects (Funds raised by transition bonds can be exclusively allocated)

LNG-fueled vessels, LNG bunkering vessels, LPG-fueled vessels, operation efficiency & optimization

Green Bonds (No.1)

Summary

| Name | Nippon Yusen Kabushiki Kaisha Unsecured Corporate Bonds No.40 (NYK Green Bond) |

|---|---|

| Issue date | May 24, 2018 |

| Pricing date | May 18, 2018 |

| Maturity | 5 years |

| Issue Amount | 10 billion yen |

| Coupon Rate | 0.290% |

| Use of Proceeds | Investment toward mainly new, but including existing (refinancing) projects indicated in NYK's "Roadmap for Environmentally Friendly Vessel Technologies," such as (1) LNG-fueled ships, (2) LNG bunkering vessels, (3) ballast water treatment equipment, and (4) SOx (sulfur oxides) scrubber systems

|

| Credit ratings | A (Japan Credit Rating Agency, Ltd.) |

Third-party Evaluation On Eligibility

Second-party Opinion

NYK has formalized a Green Bond Framework, incorporating the Green Bond Principles,*1 under NYK's broader roadmap for sustainability in order to formalize the objectives, commitments, and processes related to this bond. A second-party opinion has been received from Vigeo Eiris.

In the evaluation conducted by Vigeo Eiris, the green bonds were evaluated for its contribution to SDGs objectives and targets.

MOEJ Model Case for Green Bonds

NYK's green bonds were given approval as "a model case for green bond issuance in fiscal year 2018" by the Ministry of the Environment, Japan (MOEJ) and have been confirmed to be in alignment with the Green Bond Guidelines*2 issued by the MOEJ and its contractors.

- *1Green Bond Principles

Voluntary process guidelines regarding green bond issuance established by the Green Bond Principles Executive Committee, which is a membership association facilitated by the International Capital Market Association (ICMA). - *2Green Bond Guidelines

Guidelines, formulated and announced by the MOEJ in March 2017 with due consideration to consistency with the Green Bonds Principles, that provide issuers, investors, and other market participants with illustrative examples of specific approaches and interpretations tailored to the characteristics of Japan's bond market.

List NYK Green Bond Investors

Investors who have emphasized the significance of NYK's green bond issuance and have committed to investing (as of May 18, 2018):

- The Toa Reinsurance Company, Limited

- Sumitomo Mitsui Trust Bank, Limited

- Mitsubishi UFJ Trust and Banking Corporation

- Hokkaido Roudoukinko

- THE SUGAMO SHINKIN BANK

- Moka Shinyoukumiai

- Iwate Prefectural Credit Federation Of Agricultural Cooperatives

- The Shinonome Shinkin Bank

- Hiratsuka Shinkin Bank

- Kanagawa Prefectural Credit Federation of Agricultural Cooperatives

- Azuma shinyoukumiai

- Kansai University

- Nagoya Broadcasting Network Co.,Ltd.

- THE JAPAN CARGO TALLY CORPORATION

- Fukuchi Town

- Matsuoka Jisho Co. Ltd.

Green Bond Framework

1. Use of proceeds

NYK's medium-term management plan (formulated in 2018) [PDF:2.17MB]comprises the company's medium- to long-term environmental (CO2 emission reduction) targets.

NYK has a long-term roadmap for environmentally friendly vessel technologies. Each project that is to use proceeds of the bonds is considered based on its contribution to achieve the targets and its contribution to achieving the roadmap goals.

(1) LNG-fueled vessels

A vessel powered by liquefied natural gas (LNG) used as fuel. Compared to conventional heavy oil, LNG fuel emits 30 percent less carbon dioxide (CO2), almost no sulphur oxides (SOx) or particulate matter (PM), and up to 80 percent less nitrogen oxides (NOx).

(2) LNG bunkering vessels

A vessel that provides LNG to LNG-fueled ships.

(3) Ballast water management systems

Ships use ballast water to provide stability during a voyage. Usually seawater is pumped into the tank when cargo is unloaded, and the seawater is then discharged at another port when cargo is loaded. Ballast water treatment equipment treats marine species carried in ships' ballast water and contributes to preserving biodiversity by preventing the transfer of aquatic organisms that could harm the marine environment.

(4) SOx scrubber system

A system that uses seawater and chemicals to remove sulfur from ship exhaust gases.

2. Process for project evaluation and selection

NYK considers a set of criteria when evaluating and selecting candidate green projects.

3. Management of proceeds

The net proceeds of the bonds will be allocated to the eligible projects. Unallocated proceeds will be kept in the form of cash or cash equivalents.

4. Monitoring and reporting

NYK will disclose the allocation of proceeds to eligible projects, along with positive environmental impacts, on the company's website and through the NYK Reports (Integrated Report) annually. NYK will publish the results of a post issuance review by a third-party annually until the net proceeds of the green bonds are fully allocated.

- POST ISSUANCE REVIEW OF THE MANAGEMENT OF NYK'S GREEN BOND ISSUED IN MARCH 2020[PDF:786KB]

- POST ISSUANCE REVIEW OF THE MANAGEMENT OF NYK'S GREEN BOND ISSUED IN MARCH 2021[PDF:313KB]

Report on Use of Proceeds

All proceeds of the bond has been allocated in October 2020.

- Allocated to LNG-related investments (LNG-fueled vessels, LNG bunkering vessel): ¥8.6 billion

- Allocated to regulation compliance-related investments (scrubbers, ballast water management systems): ¥1.4 billion

- Percentage used for refinancing related to the above: 24%

Impact Report

| FY2018 | FY2019 | |

| (1) LNG-fueled vessels | 1 ship | 2 ships |

| GHG emissions | 35,730 mt per ship per year | |

| GHG reduction rate | 21% | |

| CO2 reduction rate | 30% | |

| NOx reduction rate | 30% | |

| SOx reduction rate | 99% | |

| (2) LNG bunkering vessels | 1 ship | 1 ship |

| GHG emissions | 3,647 mt per ship per year | |

| GHG reduction rate | 15% | |

| CO2 reduction rate | 30% | |

| NOx reduction rate | 76% | |

| SOx reduction rate | 99% | |

| (3) BWMS | 1 ship | 2 ships |

| Volume managed | 348,000 mt per ship per year | |

| (4) SOx scrubber | - | 9 ships |

| SOx reduction rate | 86% per ship | |

- *The period in the Impact Report is from April 1 to March 31.

- *The number of vessels above shows the cumulative number of vessels the proceeds have been allocated to and does not include ones under construction.

- *The figures regarding environmental benefits are based on annual impact assumption model, of which formalized in Vigeo Eiris' Second Party Opinion.

- *Emissions of unburnt methane through handling and combustion of LNG are taken into consideration when calculating overall GHG emissions and its reduction rate.

- *LNG-fueled vessels have no involvement in the controversial activities analysed by Vigeo Eiris.

Others

NYK participates in a shipping industry working group established by the Climate Bonds Initiative*3 and cooperates in formulating evaluation criteria for green bonds issued by shipping companies.

- *3Climate Bonds Initiative

The Climate Bonds Initiative: The Climate Bonds Initiative is an international, investor-focused not-for-profit working to mobilize bond markets for climate change solutions. The Initiative also provides a journal of record for relevant bond issuance, develops green bond evaluation criteria such as the Climate Bonds Standard, and provides policy proposals to government, finance, and industry sectors.