Corporate Governance Initiative

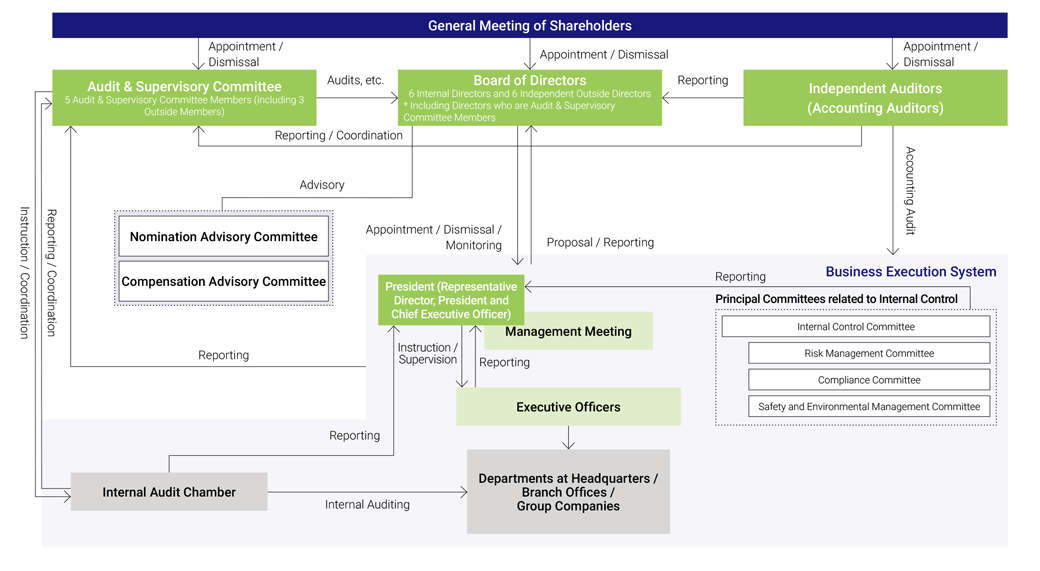

NYK's Corporate Governance Organizational Structure

Corporate Governance Organizational Structure (As of June 21, 2023)

History of Enhancing Governance

- ①Introduced a system of executive officers which was formerly know as Committee of Corporate Officers

- ②Further enhanced management transparency

- ③Formulated corporate governance code

| Year | ① | ② | ③ | Details |

|---|---|---|---|---|

| 2002 | ↓ | Introduced Committee of Corporate Officers to strengthen operational execution system | ||

| 2006 | ↓ | ↓ | Established Advisory Board to heighten transparency of business management | |

| 2008 | ↓ | ↓ | Abolished Advisory Board, appointed two outside directors Shortened term of service of directors from two years to one year to clarify management responsibility of directors and build system that expedites responses to changes in business conditions |

|

| 2010 | ↓ | ↓ | Filed notification of independent directors and auditors as stipulated by stock exchanges in Japan for all four outside directors and outside audit and supervisory board members | |

| 2015 | ↓ | ↓ | ↓ | According to the Principles of the Japan's Corporate Governance Code, the Company prepared the following

|

| 2016 | ↓ | ↓ | ↓ | Increased outside directors by one member to three, and decreased the total number of directors by one to 12 (decreased internal directors by two) Introduced a performance-based stock remuneration plan for directors and corporate officers of the Company (excluding outside directors and audit and supervisory board members of the Company) Established the Nomination Advisory Committee and the Compensation Advisory Committee Conducted a non-anonymous self-evaluation survey of all directors including outside directors, and of all audit and supervisory board members including outside members, regarding the effectiveness of the meetings of the Board of Directors |

| 2017 | ↓ | ↓ | ↓ | Decreased the total number of directors by one to 11 (decreased internal directors by one) Reviewed the items for reporting to the Board of Directors, etc., and implemented measures to further stimulate discussions Established the position of chief outside director (Yukio Okamoto) |

| 2018 | ↓ | ↓ | ↓ | Appointed an outside agency in charge of tabulation and analysis, etc., of self-evaluations of the effectiveness of the Board of Directors to further improve governance and ensure fairness Decreased the total number of directors by two to nine (decreased internal directors by two) |

| 2019 | ↓ | ↓ | ↓ | Decreased the total number of directors by one to eight (decreased internal directors by one) Established the Governance Committee |

| 2020 | ↓ | ↓ | ↓ | Revised decision-making process and established Management Meeting to ensure flexible decision-making. Changed naming conventions (changed from corporate officer to executive officer) and changed position and prominence of Meeting of Executive Officers to clarify executive responsibilities. |

| 2021 | ↓ | ↓ | ↓ | Established the ESG Management Committee for the purpose of steadily implementing ESG management. |

| 2022 | ↓ | ↓ | ↓ | Introduction of the performance-based monetary compensation plan Partially revised the details of a performance-based Stock remuneration plan |

| 2023 | ↓ | ↓ | ↓ | Transitioned to a Company with Audit & Supervisory Committee to improve effectiveness and strengthen monitoring function of the Board of Directors, and the ratio of independent outside directors has been increased to 50%. |

Organizational Design

NYK is a company with Audit & Supervisory Committee. The Board of Directors consists of 12 members including six highly independent Outside Directors and the Audit & Supervisory Committee consists of five members including three highly independent Outside Directors.

Board of Directors and Business Execution System

At the Ordinary General Meeting of Shareholders held on June 21, 2023, NYK transitioned to a Company with Audit & Supervisory Committee by obtaining approval for a change in its Articles of Incorporation to this effect.

As the business environment continues to change rapidly, the Company aims to speed up decision-making by delegating authority for important matters concerning business execution to executive directors and to improve the effectiveness of the Board of Directors by extensively discussing at Board meetings ways to improve corporate value, such as medium- to long-term management strategies, the allocation of management resources, the business portfolio, sustainability, and significant business risks. The Company aims to have a Board of Directors comprising at least one-third independent outside directors and an Audit & Supervisory Committee with the aim of strengthening the supervisory function over management by making effective use of said committee. Furthermore, the Audit & Supervisory Committee is composed of directors who are Audit & Supervisory Committee members with the authority to vote at Board of Directors' meetings in order to strengthen the monitoring function of the Board of Directors.

Under the business execution system, the Management Meeting, comprising executive directors, executive officers who are chief executives and deputy chief executives, and other personnel, deliberates on important matters related to business execution, including matters to be discussed by the Board of Directors, with decisions thereafter being made by executive directors to whom decision-making authority has been delegated.

Nomination Advisory Committee and Compensation Advisory Committee

To enhance the transparency and objectivity of the deliberation process for officer nominations and compensation, the Company has established the Nomination Advisory Committee and the Compensation Advisory Committee as advisory committees to the Board of Directors, both having a majority of independent outside directors and being chaired by outside directors. The two committees discuss key matters regarding the appointment, dismissal, and compensation of directors (excluding directors who are Audit & Supervisory Committee members) and executive officers and provide reports or proposals to the Board of Directors.

Nomination Advisory Committee and Compensation Advisory Committee—Members and Their Attendance in Fiscal 2022

| Nomination Advisory Committee | Compensation Advisory Committee | ||

|---|---|---|---|

| Chairman, Director | Tadaaki Naito | 4/4 | 2/2 |

| President, Representative Director (President and Chief Executive Officer) | Hitoshi Nagasawa | 4/4 | 2/2 |

| Director (Chief Independent Outside Director and Chief Outside Director) | Yoshihiro Katayama (Committee Chairman) |

4/4 | 2/2 |

| Director (Independent Outside Director) | Hiroko Kuniya | 4/4 | 2/2 |

| Director (Independent Outside Director) | Eiichi Tanabe | 4/4 | 2/2 |

Executive Compensation

Performance-Based Stock Remuneration Plan

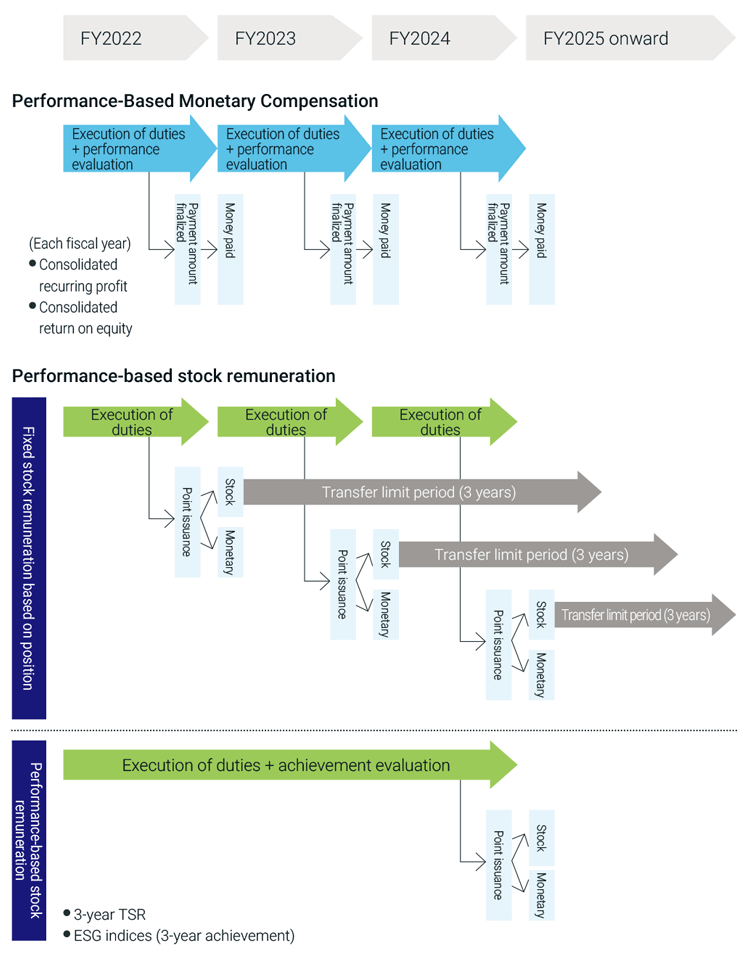

The Company introduced a performance-based stock remuneration plan in fiscal 2016 to provide a highly transparent and objective executive compensation system.

In fiscal 2022, the Company partially revised the details of said plan, with a view to further accelerating ESG management and establishing shared interests between executives and shareholders over the medium to long term.

| Overview of the Performance-Based Stock Remuneration Plan | ||

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Role-fixed portion | After the conclusion of each fiscal year but with a three-year transfer restriction after delivery |

| Performance-based portion | After the conclusion of three fiscal years | |

Performance-Based Monetary Compensation Plan

In fiscal 2022, the Company introduced a performance-based monetary compensation plan for directors concurrently serving as executive officers and for certain executive officers, with a separate budget for basic compensation. The purpose of the plan is to further increase the short-term incentives for directors and executive officers to contribute to earnings and provide a mechanism for helping increase corporate value.

| Overview of the Performance-Based Monetary Compensation Plan | |

|---|---|

|

|

|

|

|

|

|

|

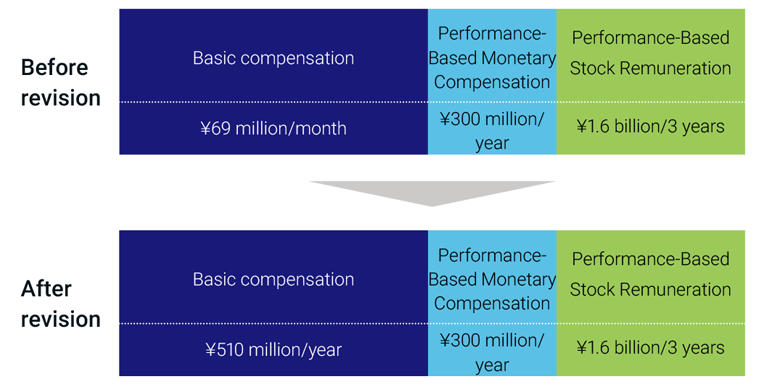

Remuneration Plan for Directors (Excluding Directors Who Are Audit & Supervisory Committee Members), etc.

- *1Of the revised total amount of basic compensation of up to ¥510 million per year, the total amount for outside directors shall not exceed ¥150 million per year.

- *2The amount of performance-based stock remuneration is the maximum amount of trust money to be contributed by the Company.

- *3Executive officers who meet certain requirements are eligible under the performance-based monetary compensation plan and the performance-based stock remuneration plan. The maximum amount shown above is the maximum amount for all eligible persons under the plans, including said executive officers.

- *4This does not include those who are ineligible under the performance-based stock remuneration plan due to non-residence in Japan.

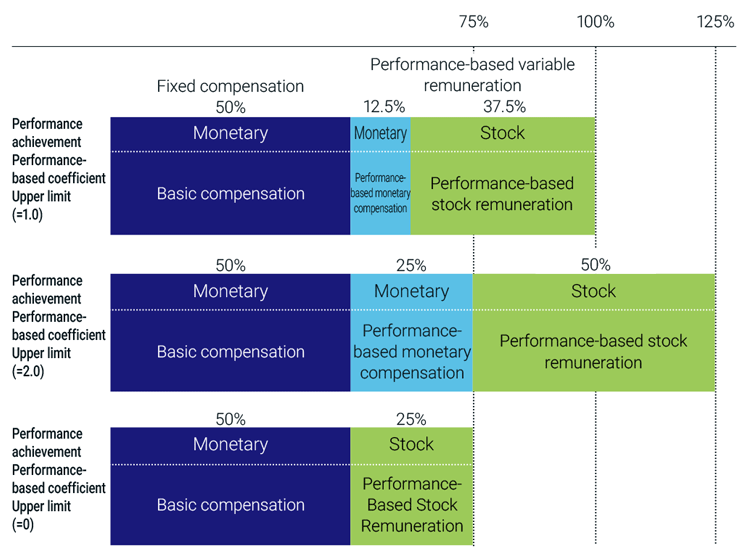

Remuneration Structure

- *The above percentages are assumed values in each case, and they may vary depending on each position.

Payment of Performance-Based Monetary Compensation and Delivery, etc., of Performance-Based Stock Remuneration

Evaluation of the Effectiveness of the Board of Directors

Since fiscal 2015, the Company has had all directors and Audit & Supervisory Committee members carry out self-evaluation surveys with the aim of further improving the effectiveness of the Board of Directors.

- 1Overview of the Fiscal 2022 Evaluation

In fiscal 2022, a survey consisting of 16 questions under five topics was conducted, taking into consideration the guidance and advice of a third party. The five topics were (1) composition and operations of the Board of Directors, (2) management strategies and business strategies, (3) corporate ethics and risk management, (4) performance monitoring and evaluation and compensation of management members, and (5) dialogues with shareholders.

- 2

Results of the Board Effectiveness Evaluation

ⅰ. Overview

As a result of a discussion based on the survey results, it was determined that the Board of Directors was functioning appropriately and its effectiveness was ensured. In fiscal 2022, in regard to (2) management strategies and business strategies, in particular, improvements were observed in a follow-up inspection of important matters that were decided upon. Furthermore, in discussing the formulation of the medium-term management plan, the Board of Directors became more involved and its effectiveness improved. On the other hand, there are still matters that require even deeper discussion, such as diversity and human resource strategies, and the need to secure adequate deliberation time was recognized.ⅱ. Issues Recognized in Fiscal 2021

-

Strengthening of monitoring functions

The continual checking of key performance indicators (KPIs), direct exchanges of opinions, and discussions of which KPIs should be considered important in formulating the medium-term management plan have resulted in a certain level of improvement; however, it was recognized that this issue requires further attention. -

Diversity and human resource strategies, etc.

This issue was discussed in the process of personnel system reform and formulation of the medium-term management plan, and the need for continued discussion was recognized.

ⅲ. Change in Organizational Design

As changes in the business environment grow even more pronounced, management held several discussions to decide upon the best organizational design for the Company in order to achieve healthy and sustainable increases in corporate value, including responding to recognized issues. These discussions concluded that transitioning to a Company with Audit & Supervisory Committee would be the most ideal. -

- 3Initiatives Taken in Fiscal 2023

The Company transitioned to a Company with Audit & Supervisory Committee by a resolution of the Ordinary General Meeting of Shareholders held on June 21, 2023.

Accordingly, decision-making will be accelerated by delegating authority over important matters of business execution to executive directors, while the Company will work to strengthen monitoring functions. At the same time, the Board of Directors will aim to increase its effectiveness by allocating more time to deliberating on matters that lead to corporate value growth, such as medium- to long-term management strategies, the allocation of management resources, the business portfolio, sustainability, and significant business risks. The Board will also address ongoing issues such as diversity and human resource strategies by recognizing them as important issues.

Training for Directors and Corporate Officers

In order to achieve the medium- to long-term vision of the Group and improve sustainable corporate value, we provide opportunities for inside and outside directors, and executive officers to participate in in-house training and external courses to maintain the effectiveness of the Board of Directors, deepen understanding of legal compliance such as fair trade, and improve governance functions.

We provide practical training, including timely lectures on the latest trends, as well as education for gaining knowledge on themes such as the Companies Act, internal control, risk management, compliance, crisis management and business analysis, and financial strategy.

Training Menu

- Duties and responsibilities of directors (based on the Companies Act, Corporate Governance Guidelines)

- Internal control / compliance

- ESG Management, Human rights, etc.

Policy for Holding Strategic Shareholdings

The Company is pursuing a policy aimed at reducing its strategic shareholdings. Also, as stipulated in the Corporate Governance Guidelines adopted in November 2015, the Board of Directors annually conducts a comprehensive review of the purpose and objectives of holding individual strategic shareholdings with a focus on the return targets based on the capital cost, the revenue from dividends, and impact on the Company's business activities. Based on these, we decide on initiatives for reduction. The number of listed companies in the Company's strategic shareholdings was 35 as of the end of fiscal 2022, down 21 from the total of 56 as of the end of fiscal 2016.

The Company's current strategic shareholdings are of companies considered to be important business partners with which the Company expects to maintain long-term relationships that will help maintain stable results for the Company. The Board of Directors determined that retaining these shareholdings is suitable for maintaining and strengthening relations with those companies. The Company has set specific standards related to the exercise of voting rights with companies for which it has strategic shareholdings. Under these standards, the Company confirms whether a certain vote will damage the investee company and whether it will contribute to the corporate value of the Company. After these criteria are confirmed and evaluated, a decision to approve or reject a proposal is made.

Auditing System

The Audit & Supervisory Committee of the Company consists of five Audit & Supervisory Committee Members, including three Independent Outside Directors (including two female Committee Members), and, as an independent body entrusted by the shareholders, performs audits of the Directors execution of their duties.

Specifically, in conformity with the Rules on Audit & Supervisory Committee and the Code of Audit & Supervisory Committee Auditing and Supervising Standards prescribed by the Audit & Supervisory Committee and in accordance with audit policies and plans, etc., the Committee systematically pursues audit activities on a day-to-day basis in close coordination with the internal audit division, assigning priority to auditing of matters such as the status of development and implementation of internal control systems, the status of development of operational foundations, and the status of promotion of management plans and other measures. The Audit & Supervisory Committee Members also attend important meetings, including Board of Directors meetings, request briefings about the status of the execution of their duties from the Executive Directors, employees, and others, and express their opinions. With regard to the Group companies, they communicate and exchange information with the Directors of those companies or the division, etc. in charge of the Company and, when necessary, receive business reports and seek briefings. Furthermore, they also coordinate with the Audit & Supervisory Board Members, etc. of the Group companies through liaison meetings and other means, in their efforts to raise the quality of audits of the Group as a whole. In addition, the Company has established an Audit & Supervisory Committee's Office to assist the Audit & Supervisory Committee Members in their duties and to support the smooth execution of those duties and has assigned three dedicated staff to that Office. The Outside Directors who are Audit & Supervisory Committee Members express their opinions from their respective independent positions at meetings of the Board of Directors, Audit & Supervisory Committee, and other forums, based on their wealth of experience and high degree of knowledge in their individual fields, and conduct audit activities such as hearing reports from the major Executive Directors and Executive Officers, the Accounting Auditors, and others. In so doing, they are contributing to the sound and fair management of the Company.

Members of the Audit and Supervisory Board and Board Meeting Attendance (in Fiscal 2022)

| Name | Attendance | |

|---|---|---|

| Internal | Noriko Miyamoto | 16/16 |

| Eiichi Takahashi | 16/16 | |

| Outside | Hiroshi Nakaso | 15/16 |

| Satoko Kuwabara | 16/16 |

Accounting Audits

The certified public accountants who audit the Company's consolidated and non-consolidated financial statements are Yoshiaki Kitamura, Takuya Sumita, and Katsuhiro Shibata, all of whom are with the accounting firm Deloitte Touche Tohmatsu LLC. The fiscal year ended 31 March 2007 was the first year for continuous audits by the accounting firm, and the number of years for continuous audits by each member as an engagement partner is seven years or less. These accountants are assisted by 25 certified public accountants, four successful candidates of the certified public accountant examination, and 47 others. Audits are undertaken in accordance with standards generally accepted as fair and appropriate.

Major overseas consolidated subsidiaries that have financial statements and internal controls audited generally appoints accounting firms that belong to the same network (Deloitte Touche Tohmatsu Limited) as the independent auditor for the Company.

The Audit and Supervisory Board evaluates accounting auditors regarding their auditing systems, independence, and performance in accordance with NYK's standard evaluation sheet.

The Board also decides whether to renew or dismiss accounting auditors each year.

Independent Auditor Remuneration

| FY2021 | FY2022 | |||

|---|---|---|---|---|

| Remuneration paid for audit certification activities (Millions of yen) |

Remuneration paid for non-audit activities (Millions of yen) |

Remuneration paid for audit certification activities (Millions of yen) |

Remuneration paid for non-audit activities (Millions of yen) |

|

| The Company | 196 | 2 | 207 | 42 |

| Consolidated Subsidiaries | 125 | 0 | 107 | 0 |

| Total | 321 | 3 | 314 | 42 |