Nov. 12, 2025

NYK to Issue New Transition Bonds

Funding for Decarbonization Projects, Including LNG-Fueled Vessels

NYK plans to issue transition bonds in late November, with detailed issuance conditions to be announced at a later date. This marks the company’s fifth issuance of such bonds.

Transition bonds are designed to facilitate the transition to a low-carbon society. The funds raised will be allocated to projects aligned with our medium-term management plan, Sail Green, Drive Transformations 2026 — A Passion for Planetary Wellbeing

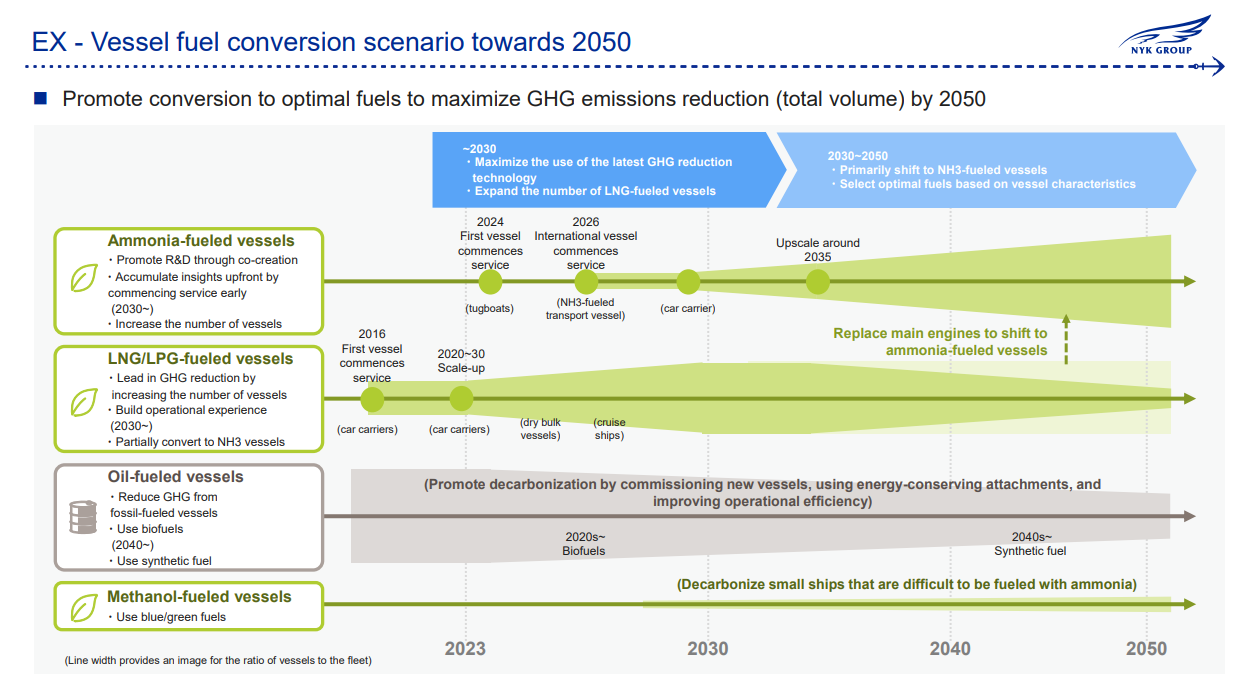

. These projects emphasize long-term transition strategies that contribute to decarbonization, including investments in LNG-fueled vessels.

Since issuing the shipping industry’s first green bonds in 2018 and subsequently Japan's first transition bonds in 2021, we have been at the forefront of sustainable finance. NYK remains committed to advancing sustainable finance while raising stakeholder awareness of our growth strategy, which is built on the foundation of sustainable management.

Bond Summary

• Name: NYK Unsecured Corporate Bond No. TBA (Transition Bonds)

• Issuing Entity: NYK (Nippon Yusen Kaisha)

• Maturity: 5 years

• Issue Amount: Around 20 billion yen

• Pricing Date: Late November 2025

• Use of Proceeds: New and existing projects referenced in "Vessel fuel conversion scenario towards 2050" from NYK's medium-term management plan, LNG-fueled vessels, etc.

• Second-Party Opinion: DNV Business Assurance Japan K.K

• Structuring Agent: Mitsubishi UFJ Morgan Stanley Securities Co. Ltd.

Our Framework and External Evaluation

• NYK Line Green/Transition Finance Framework

• Second-Party Opinion on Our Issued Framework

Vessel Fuel Conversion Scenario towards 2025 Released in Our Medium-Term Management Plan

The news on this website is as of the date announced and may change without notice.