Apr. 10, 2024

NYK to Issue Transition Bonds and Green Bonds

Boosting Ship Fuel Conversion from a Financing Perspective

NYK will issue its 47th unsecured corporate bonds (transition bonds) and 48th unsecured corporate bonds (green bonds) in the Japanese domestic market in early April. This will be NYK’s second green bond issuance since May 2018 and third transition bond issuance since July 2023.

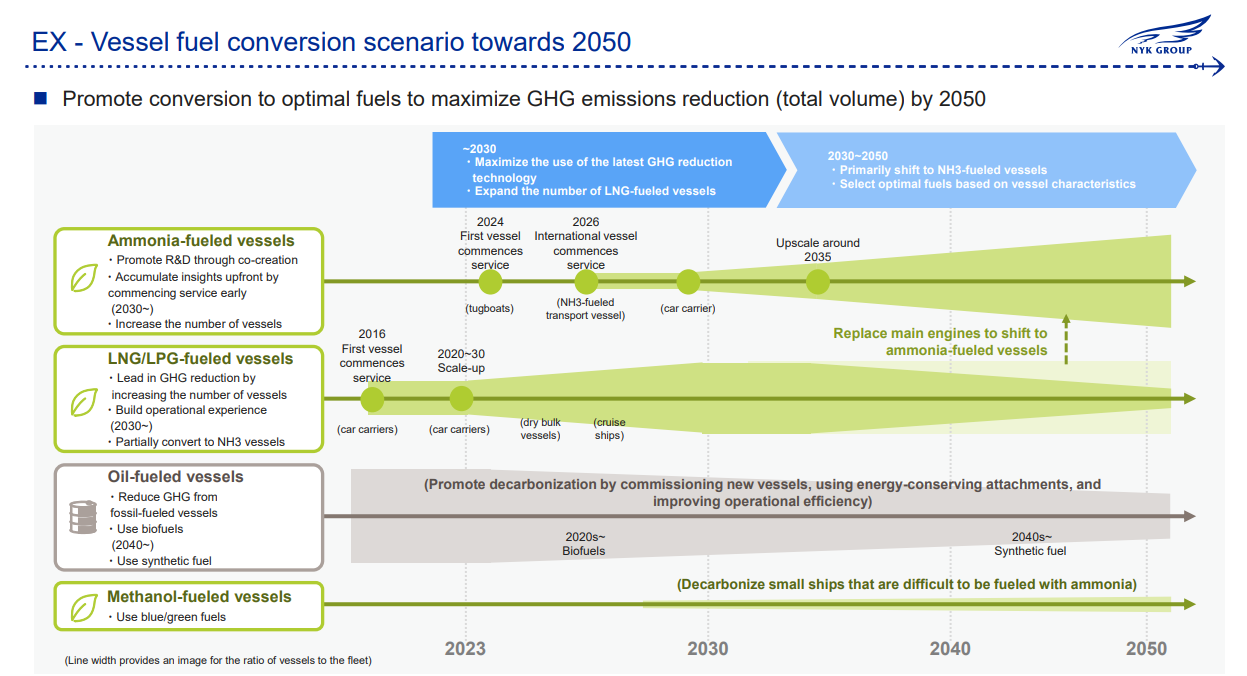

NYK will issue the bonds to accelerate ESG management advocated in the company’s medium-term management plan “Sail Green, Drive Transformations 2026 - A Passion for Planetary Wellbeing -“. NYK will use the funds raised by the transition bonds for projects aligned with the company’s long-term transition strategy toward decarbonization (transition projects), such as LNG-fueled vessels. On the other hand, the funds generated by the green bonds will be used for projects that mitigate global warming (green projects), such as ammonia-fueled ammonia carriers to be built through the Green Innovation Fund.

NYK issued the shipping industry’s first green bonds in 2018 and Japan's first transition bonds in 2021. The company will continue to promote ESG finance and aim to have its growth strategy based on ESG management.

Bond Summary

| Name | NYK Unsecured Corporate Bond No. 47 (Transition Bonds) |

NYK Unsecured Corporate Bond No. 48 (Green Bonds) |

|---|---|---|

| Issuing Entity | NYK (Nippon Yusen Kaisha) | |

| Maturity | 5 years | 10 years |

| Issue Amount | 20 billion yen maximum | 10 billion yen |

| Pricing Date | Early April 2024 | |

| Use of Proceeds |

New and existing projects referenced in "Vessel fuel conversion scenario towards 2050" from NYK's medium-term management plan | |

| LNG-fueled vessels, etc. | Ammonia-fueled vessels, etc. | |

| Second-Party Opinion | DNV Business Assurance Japan K.K* | |

| Lead Managers | Mitsubishi UFJ Morgan Stanley Securities Co. Ltd., Nomura Securities Co. Ltd., SMBC Nikko Securities Inc., Daiwa Securities Co. Ltd. | |

| Structuring Agent | Mitsubishi UFJ Morgan Stanley Securities Co. Ltd. | |

* DNV Business Assurance Japan K.K

Prior to the execution of the green/transition financing, NYK obtained a second-party opinion from DNV in January regarding NYK’s financial framework. NYK also obtained an annex to the second-party opinion concerning the use of proceeds of transition bonds and green bonds and the eligibility of reporting.

Related Sustainable Domestic Goals (SDGs)

Related Press Releases

This press release has been prepared for the sole purpose of publicly announcing the Company’s issuance of the bonds and not for the purpose of soliciting investment or engaging in any other similar activities within or outside Japan

The news on this website is as of the date announced and may change without notice.