Jul. 30, 2021

NYK Issues First Transition Bonds in Japan

Accelerating initiatives to reduce greenhouse gas emissions

On July 21, NYK announced the below items and conditions for the issuance of its 43rd and 44th unsecured corporate bonds (transition bonds) within the Japanese domestic market, becoming Japan’s first company to issue such bonds.

A transition bond is one in which the proceeds are used for the purpose of funding projects that contribute to the company's long-term transition strategy to reduce greenhouse gas emissions. By issuing transition bonds to secure various funding resources for low carbon, decarbonization solutions, NYK will accelerate its greenhouse gas emission reduction.

This issuance has been selected as the first model case for transition finance by Japan’s Ministry of Economy, Trade and Industry.

NYK issued the first green bonds in the global shipping business sector in 2018, followed by participation in green loans and sustainability linked loans. Through environmentally efficient investment supported by ESG financing, NYK will demonstrate the company’s growth strategies based on ESG initiatives to wide range of stakeholders.

Summary of Transition Bonds

| Name | NYK Unsecured Corporate Bonds No. 43 (Transition Bond) | NYK Unsecured Corporate Bonds No. 44 (Transition Bond) |

| Issue Amount | 10 billion yen | 10 billion yen |

| Maturity | 5 years | 7 years |

| Coupon rate | 0.26% per annum | 0.38% per annum |

| Issue price | 100 yen per 100 yen of each bond | |

| Payment date | July 29, 2021 | |

| Maturity date | July 29, 2026 | July 28, 2028 |

| Principal payment | Bullet redemption | |

| Bond offering | Public offering | |

| Secured or unsecured | Unsecured | |

| Bond Rating | A- (Japan Credit Rating Agency) | |

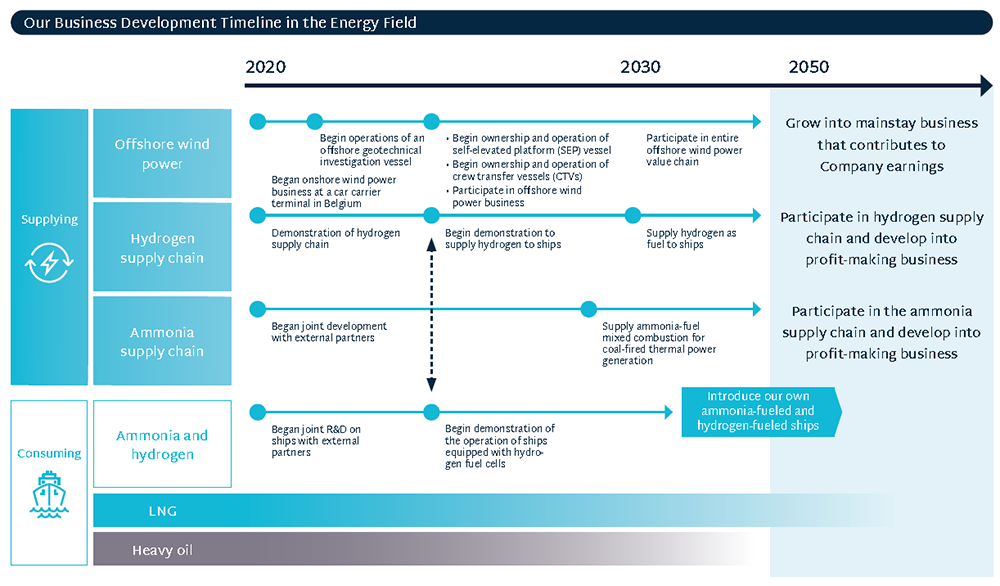

| Use of Proceeds | New and existing projects referenced in “Our Business Development Timeline in the Energy Field” in the NYK Group ESG Story.* Offshore-wind support vessels, ammonia-fueled vessels, hydrogen fuel-cell vessels, LNG-fueled vessels, LNG-bunkering vessels, LPG-fueled vessels, improvement of efficiency and optimization in vessel operation |

|

| Second Party Opinion Provider | DNV Business Assurance Japan K.K. | |

| Lead managers | Mitsubishi UFJ Morgan Stanley Securities Co. Ltd., Nomura Securities Co. Ltd., Goldman Sachs Japan Co. Ltd., Mizuho Securities Co. Ltd. | Mitsubishi UFJ Morgan Stanley Securities Co. Ltd., Nomura Securities Co. Ltd., SMBC Nikko Securities Inc. |

| Structuring Agent | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. | |

On February 3, NYK released the NYK Group ESG Story, which aims to further integrate ESG into the company’s management strategy and promotes activities that contribute to the achievement of the SDGs (Sustainable Development Goals) through business activities. The NYK Group will encourage new value creation as a sustainable solution provider through a business strategy by strongly promoting ESG financing.

<NYK Group ESG Story>

A guideline detailing concrete efforts to integrate ESG into management strategies of the NYK Group. Details can be found in the following press release.

* NYK’s business development timeline in the energy field in the NYK Group ESG Story

Use of the SDGs bond logo is authorized by the Japan Securities Dealers Association.

This press release has been prepared for the sole purpose of publicly announcing the Company’s issuance of the Bonds, and not for the purpose of soliciting investment or engaging in any other similar activities within or outside Japan.

The news on this website is as of the date announced and may change without notice.