ESG Management Continues to Move Forward

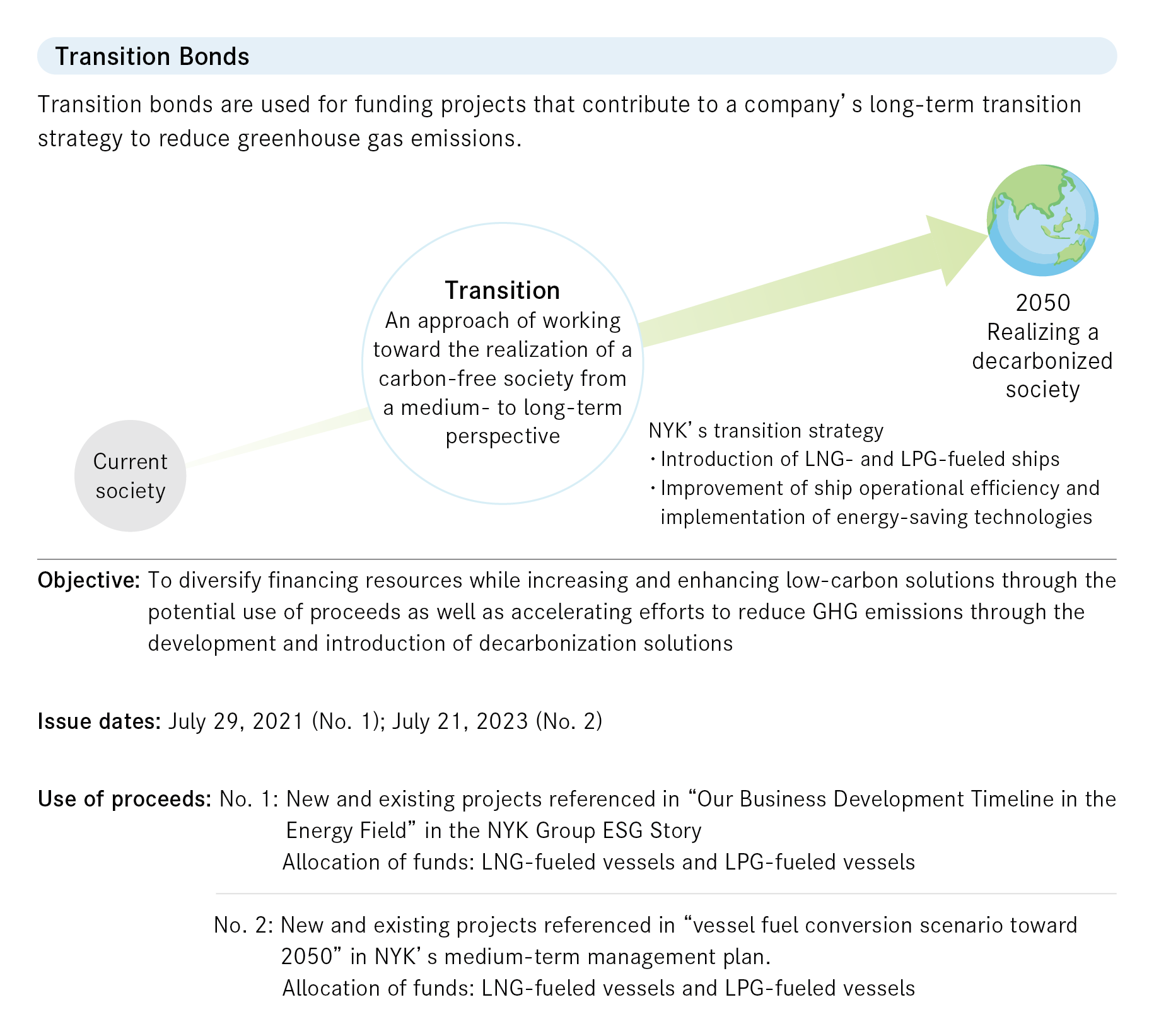

Approximately two years ago, NYK pioneered a financing method in Japan that triggered a new trend in sectors with high levels of GHG (greenhouse gas) emissions. In July 2021, NYK issued transition bonds. Initiatives to systematically accelerate decarbonization will require huge investments. How will we achieve sustainability in maritime shipping while gaining the understanding of stakeholders? The Finance Group, which is responsible for financing for NYK, has also been required to take on new challenges in its operations.

Midori Yanase, who is the manager of the Finance Group’s Financial Strategy Development Team, explains transition bonds.

“They are a new financing method aimed at supporting companies that are steadily implementing measures to reduce GHG emissions based on long-term strategies for the realization of a decarbonized society.”

Prior to issuing transition bonds, NYK issued green bonds, which are aimed at financing investments that contribute to decarbonization. Yanase recalls the purpose of green bonds.

“We issued green bonds in 2018. The funds raised through green bonds were used directly for environmentally friendly capital investment. Then, the system changed, and transition financing was introduced.”

The transition bond financing method suited NYK as the Company had significantly heightened the profile of its decarbonization initiatives with the release of the NYK Group ESG Story

in February 2021.

Road to Japan’s First Transition Bond Issuance

No one knew where to start with the unprecedented issuance of transition bonds.

Team member Yushi Nagai explains how the Group approached the task.

“We were able to break through this barrier precisely because the NYK Group takes a Groupwide approach to everything. The cooperation of many divisions was indispensable for this project. I heard that each department was extremely cooperative despite their busy work schedules. Another factor, I believe, was the strong determination to promote ESG management not only in the Finance Group but throughout the entire Group.”

When the No. 1 transition bonds were issued, Nagai was working in the Energy Division, to which the funds were allocated. He says that before being transferred to the Finance Group, he knew of transition bonds as an innovative financing method. However, after joining the Finance Group and hearing more about the financing method, he realized how challenging the project was.

Learning as they went along, the person in charge and relevant parties began the process from scratch. First of all, they developed the NYK Green/Transition Bond Framework. This framework clarified goals, ensured transparency in the use of proceeds, and established reporting-based disclosure and other specific parts of the process through until bond issuance.

Nagai adds that these were not the only difficulties.

“At the time, the concept of ‘transition’ was not well understood at all. We struggled to gain widespread acceptance of the concept. For example, when we began issuing bonds, we received some harsh comments from investors. They asked if switching to transition bonds when green bonds had already been issued was a step backward from an ESG perspective.”

Yanase recalls similar challenges.

“Some investors simply viewed transition bonds as corporate bonds issued by the NYK Group and did not seem to appreciate the original intent of the bond issuance.”

Before the issuance, team members had expectations and felt frustrated that their intentions were not fully conveyed.

Nonetheless, steady debt investor relations* gradually furthered investors’ understanding. Yanase says that they also referred to the NYK Group ESG Story when explaining the concept.

“The realization of a carbon-free society is not an endeavor that can be solved in a single step. We should work steadily to decarbonize based on a medium- to long-term timeline because the concept of transition is widely recognized by relevant ministries and agencies.”

Yanase, who was in charge of debt investor relations at the time, recalls the assistance received.

“Debt investor relations activities entailed repeatedly meeting with financial institutions and investors over a three-day period. Naturally, members of the Finance Group attended because it was their main job. However, members of other divisions also attended every day despite their busy schedules. These divisions included the IR Group and the Environment Group, which is now the Decarbonization Group. To be honest, there were times when members of other divisions spent more time talking than members of the Finance Group. It must have been quite a burden, but I am truly grateful that they were willing to take on the task.”

The activities were a success. The number of subscribers far exceeded expectations. This was the moment when the NYK Group received a firm ESG evaluation for its adoption of a new financing method.

Understanding of ESG Financing Deepening

After issuing the No. 1 transition bonds, investors went from responding dubiously, which stemmed from their anxiousness and a sense of unfamiliarity, to responding with hope and confidence. Investors acquired an adequate understanding of not only decarbonization initiatives but also the concept of transition and the NYK Group’s commitment to ESG management. It was decided that No. 2 transition bonds would be issued in July 2023.

Nagai recalls the second bond issuance.

“I felt that investors had gained considerable insight into and understanding of ESG financing, especially transition financing. In fact, with respect to the No. 2 transition bonds, some investors clearly stated that they would no longer invest in bonds unless they included some type of ESG-focused element.”

Yanase felt a similar change in the reaction of investors.

“The market environment was not very favorable when the No. 2 transition bonds were issued. However, I think the issuance of transition bonds enabled us to demonstrate the close link between the bonds and our medium- to long-term decarbonization strategy as well as our ESG management. This was a major advantage. As a result, we received a large number of subscriptions.”

The No. 2 transition bond issuance led to the realization that environmental investment is gaining further support from society and that Groupwide strategy is in line with social trends.

Hopes for Future Financing and New Challenges

The Finance Group will continue to raise funds so that the NYK Group can continue its decarbonization strategy initiatives. Nagai emphasizes the key role of the Finance Group in ESG management.

“The Finance Group finances various business divisions. This requires us to have relationships with these divisions. Sometimes, we must realize synergies that transcend team boundaries. We want the Finance Group to play a pivotal role in collaborations that further entrench ESG management throughout the Group. Our initiatives for transition bonds are a good example of this approach.”

Yanase agrees.

“We believe our job is to consider the most appropriate financing for the Group’s businesses at any given time. There is no guarantee that this will always be transition financing. However, I feel that ESG management-based financing is a social trend, and investors are seeking such financing.”

The NYK Group will continue to take an aggressive approach with regard to ESG management. As was the case with the issuance of transition bonds—even if the initiatives are unprecedented—the NYK Group will continue blazing a trail through innovative value creation and cohesive cross-divisional initiatives that mobilize the entire Group.

(Interview September 5, 2023)

- *Debt investor relations

Activities focused on explaining to bond investors about bonds that are to be issued