Popularization in the Philippines

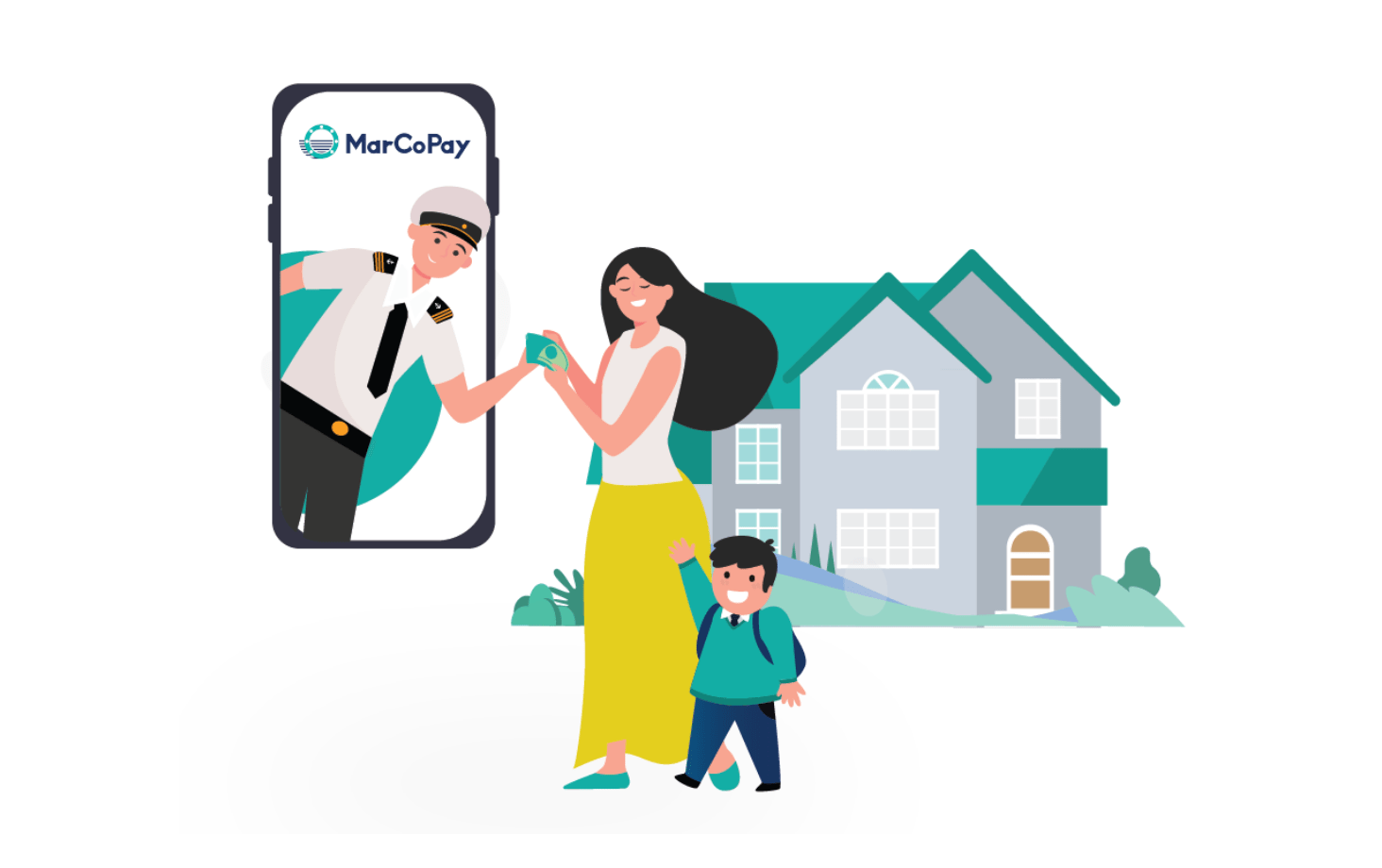

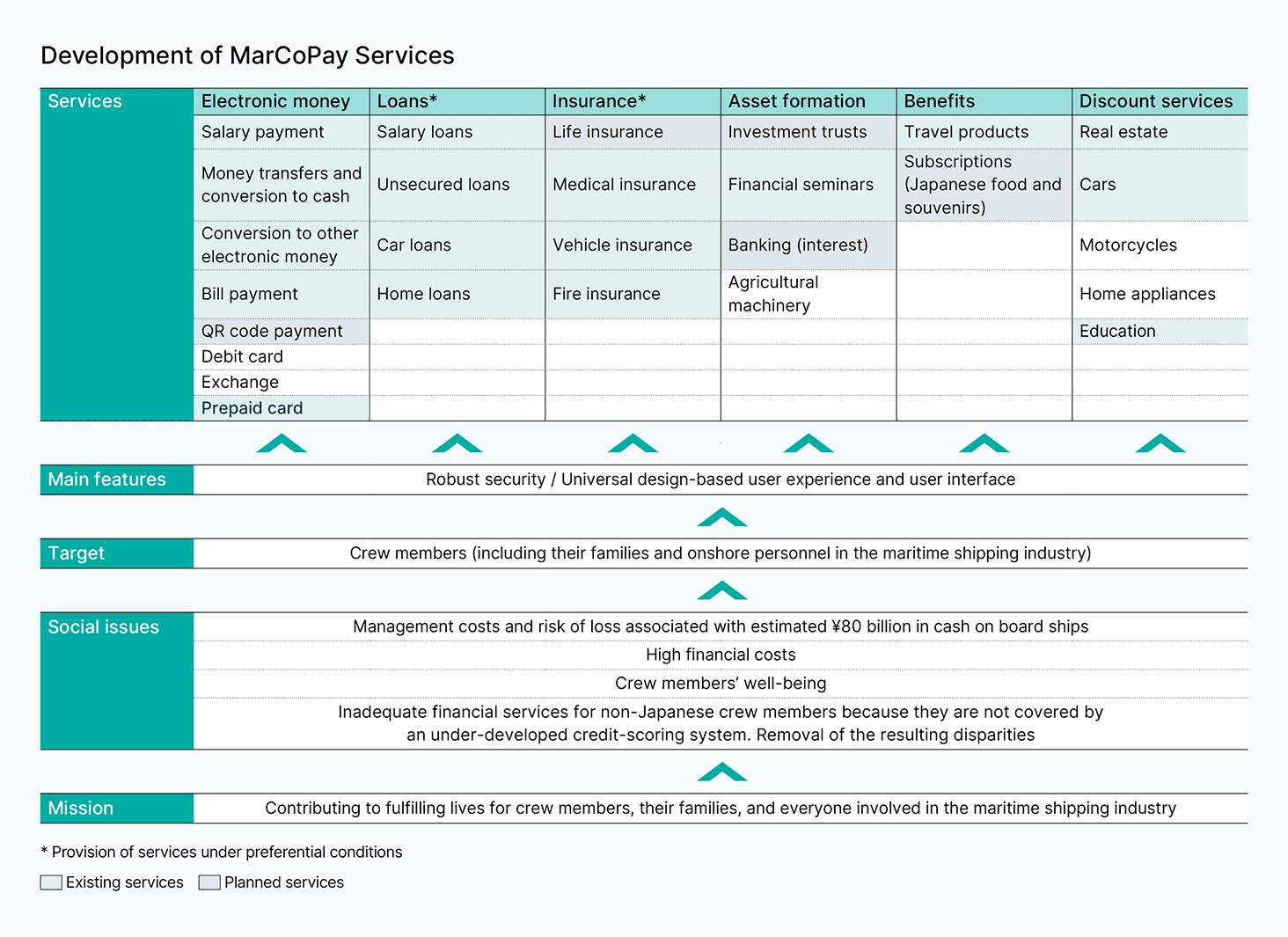

About ¥80 billion in cash is kept on board ships around the world. Often, crew members are paid partly in cash for voyages that can last from six to 10 months. Shipping companies send cash to banks near ports where ships are berthed. However, transfer fees can be very high in some countries and regions. Moreover, security concerns in certain countries make insurance coverage sometimes necessary when transporting cash from banks to ships. Needless to say, the management costs and risk of loss associated with keeping cash on board are high. Aiming to eliminate such problems at a stroke, we have created MarCoPay electronic money. The MarCoPay platform makes it possible to pay crew member salaries in electronic money. The platform also enables crew members to transfer electronic money between banks and individuals, change MarCoPay into other types of electronic money that are popular in the Philippines, and apply for loans and insurance.

Services began approximately two years ago. The number of users of MarCoPay, which is an electronic money-enabled platform that supports the day-to-day lives of crew members, is growing rapidly. MarCoPay facilitates basic financial services such as balance checks and money transfers. It also offers preferential conditions for services that crew members need at each stage of their lives. These services include various types of loans and insurance as well as a range of member discounts.

The Philippines provides more crew members for oceangoing ships than any other country. Crew members earn salaries that are above the average for the country. However, the credit they should be able to earn is not appropriately recognized by society and social systems there. MarCoPay cooperated with crew-manning companies to visualize the economic value of crew members and rapidly provide them loans at appropriate interest rates. MarCoPay has received a lot of positive feedback from crew members, their families, and partner companies. This positivity has allowed Toshiaki Fujioka, the president and CEO of MarCoPay Inc., to fully understand the significant progress being made. However, behind such seemingly smooth progress, there are stories of decisiveness, determination, and a long process of trial and error before the platform’s launch.

Independent Design and Development for Appropriate Services

MarCoPay began with 20 to 30 employees, mostly seconded from Nippon Yusen Kabushiki Kaisha (NYK) and business partner Transnational Diversified Group(TDG). The company’s workforce has grown through the secondment of employees from Marubeni Corporation—a major trading house that began investing and participating in the company in June 2021—and from the major commercial bank Mitsubishi UFJ Bank Ltd. The workforce has also grown due to the direct hiring of personnel with experience of working for local banks and IT companies in the Philippines. At present, MarCoPay and its three subsidiaries have a total of 80 employees. The company has been recruiting more personnel to not only increase and enhance its service lineup but also strengthen an in-house organization tasked with system development.

In launching the MarCoPay platform initially, the company built up their computer systems with an outside partner that has expertise in such development. However, when these systems came into operation, they realized the obvious need to develop them pursuant to local financial systems and regulations. Regarding the early days, Fujioka says,

“After much hesitation, we decided to focus more on the local needs of local crew members and their families and rebuild the systems in line with their requirements.”

Immediately after making this decision, Fujioka worked to identify specific local needs, business practices, and regulations with his team. Then, the team finally rebuilt the systems by themselves. Talking about his belief that addressing these issues led to major benefits, Fujioka states,

“While making many mistakes, we have gradually developed systems suited to local requirements, and the number of users has steadily grown. For the company, the transformational events were the realization of services that are more user-friendly and, above all, the experience of everyone pulling together to resolve individual problems.”

Overview of MarCoPay Inc.

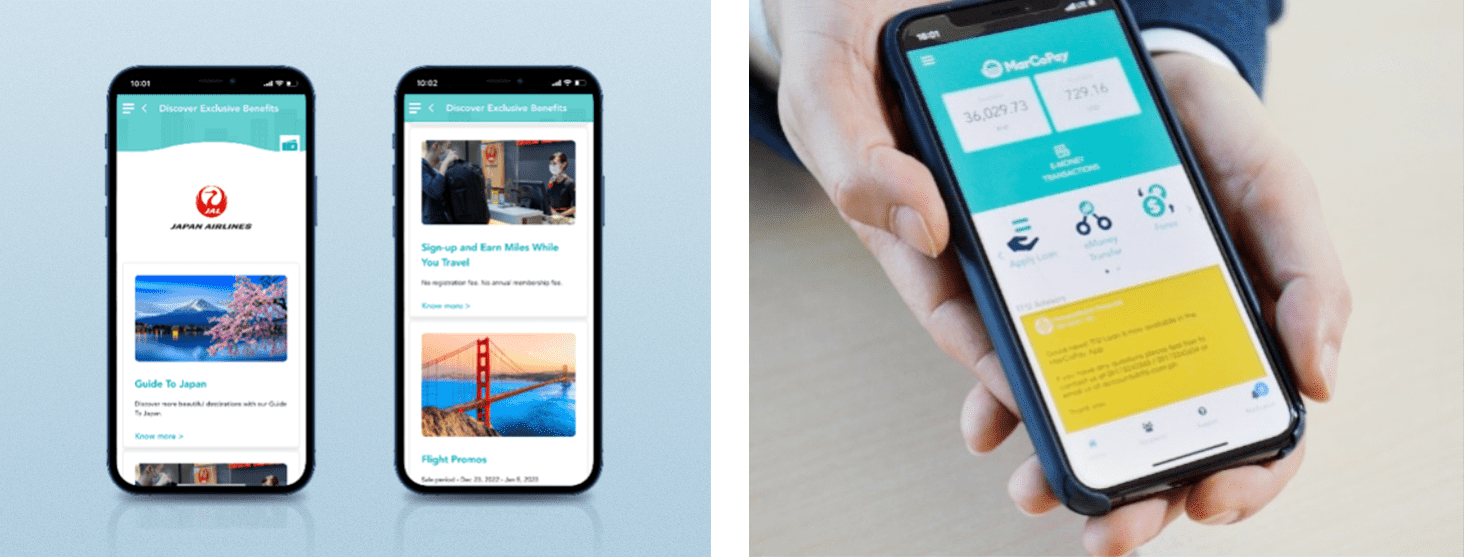

In Tandem with Business Partners

By the end of 2023, MarCoPay will offer 15 services, including salary payment, money transfers and conversion to cash, and loans. This expanded lineup of services will cover a broad range of categories, such as insurance and discounts. Through a business tie-up concluded with Japan Airlines Co., Ltd. (JAL) in December 2022, MarCoPay has launched travel services that utilize JAL’s domestic and international network. By using MarCoPay, members can access a dedicated website for booking and purchasing airline tickets and increase free baggage allowances.

A MarCoPay commercial ecosystem is clearly beginning to take shape. However, Fujioka emphasizes that this is not the main goal:

“Our mission is to help crew members and their families lead happy lives. MarCoPay is a service platform based on electronic money. But, we cannot fully support the daily lives of crew members and their families through electronic money alone. We are currently building and expanding highly convenient banking services through the development of credit scoring, which establishes credit risk scores, and through strategic tie-ups with financial service providers in the Philippines.” Fujioka continues,

“Electronic money does not earn interest or loyalty points in the Philippines. So, to help crew members build their wealth through asset formation, we hope to have established banking services by around the second half of 2023.”

The company has carefully designed MarCoPay to make it as easy as possible for crew members to use. Telecommunications at sea are often unreliable. This means that some crew members may be concerned about what would happen to their salaries if communications were interrupted while using the app. Through repeated tests under conditions of slow or interrupted internet communication, the company has rigorously strengthened security. The platform’s structure, design, and operations have been made as simple as possible so that MarCoPay is readily usable even with low communication volumes. In terms of the thinking behind the platform’s ongoing development, Fujioka explains,

“Nowadays, the communication environments of ships have greatly improved, especially among those operated by major shipping companies. But, many ships still have poor communication environments. We have been optimizing the app to lessen the burden of its operations, simplifying the software program, and reducing the amounts of data exchanged. One of MarCoPay’s competitive advantages is that even in poor communication environments crew members can still use the platform with peace of mind.”

Through its network of partners and supporters, MarCoPay team members are engaged in numerous business discussions with companies in China, Greece, Singapore, and other countries where Philippine nationals often board their flagged ships. In these discussions, Fujioka has received enthusiastic responses, which show that the global emphasis on environmental, social, and governance (ESG) matters will likely provide a major tailwind for the growth of MarCoPay. Fujioka says,

“This year, a team visited Greece to liaise with stakeholders. Reflecting Europe’s strong focus on ESG, human rights, and well-being is very important to companies in the region. Consequently, our services and approach were very favorably received. Well-being will be a central theme in the rollout of MarCoPay services going forward.”

Potential for Significantly Extending MarCoPay’s Scope

The MarCoPay team is targeting a wide range of possibilities. These include investments and participation from trading houses and banks, the formation of tie-ups with airlines, and the rollout of services in countries other than the Philippines. In addition, the team is considering providing support to other industries in the Philippines through the establishment of partnerships with automobile and agricultural machinery manufacturers. MarCoPay is shifting from a phase of starting up completely new operations into one of significant expansion. Nonetheless, the company will remain firmly focused on its original mission, as Fujioka says:

“As the lineup of MarCoPay services expands, new risks and unexpected situations will arise.”

The MarCoPay team will also explore the possibility of offering services to non-Filipino crew members and to workers engaged in other occupations. Building on the successes it has achieved after many ups and downs, the company will venture into new fields. Without losing sight of its founding mission of supporting the well-being and financial resources of crew members, MarCoPay is set to further evolve its ESG story.

(Interview February 1, 2023)